Swing trading is a way of dealing in the forex market which is open for a medium term of trade that consists of buying and holding positions for a few days or some weeks to get the most of the price movements or what we call the swings in the market.

It differs from day trading, which has its attention on the immediate movements happening in the market daily, it is quite different from long-term trade as well which attempts to gain big money over a long duration of time. This way of trading is more appropriate for those who make an effort to look at the market and who cannot analyze trends and patterns regularly.

Swing trading is quite famous in the market especially among forex traders to make sure that there is potential time management and to earn big bucks. By taking help from platforms like MetaTrader 4, traders can easily use high-tech tools and measures to find the best-suited trading windows that give them the best returns.

Understanding How Swing Trading Plays Out in the Market

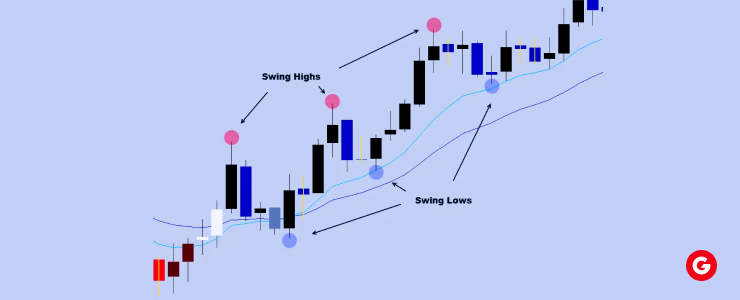

Swing trading generally consists of knowing and recognizing trends, guidance, and support to resist potential losses and to have a tentative idea of the price fluctuations via chart patterns.

Traders are often seen using a set of technical and integral analysis to make decisions after being thorough with the market.

Tools like moving averages, Fibonacci retracements, and oscillators are essential in understanding the possible entry and exit points in the market.

How to Swing Trade in the Forex Market?

- Being Thorough with the Market: Decide whether the market is moving in an uptrend, downtrend, or sideways pattern to figure out your next move.

- Analyze Support and Resistance: Pinpoint the levels of price where the action coming in via money fluctuation is likely to reverse or come together.

- Set Entry and Exit Points: Use advanced and high-tech indicators and patterns to find the best entry and exit levels to make the most in the market.

- Monitor the Market: Keep a check on your positions regularly so that you can make swift changes and move according to the stop-loss or take-profit levels as and when needed.

- Use a Trusted Platform: Platforms such as MetaTrader 4 have gained favor from all traders as it give tools to analyze the market and perform trades smoothly as per the risk appetite of the trader.

Benefits of Performing Swing Trading in Forex

- Flexibility: Swing trading does not need to be monitored on a regular basis nor does it require one to perform trade every day, making it the best option for part-time traders.

- Reduced Stress: Keeping hold of trade positions over a period of days reduces the pressure of moving your holdings according to minute-by-minute price changes, which is a common phenomenon in the forex market.

- Potential for Significant Gains: Getting a hold over multi-day price swings can make you earn a good amount of profits.

- Leverage Opportunities: Utilizing tools like CFD trading can increase the gains at a huge scale but one has to remember that this does not come without its fair share of risks.

Tools Needed to Perform Swing Trading

- Technical Measures: Moving averages, MACD, RSI, and Bollinger Bands are practices that are very often used by traders.

- Chart Patterns: Head and shoulders, double tops or bottoms, and triangles. There can be many other chart types and patterns.

- Fundamental Analysis: Economic calendars and news updates to analyze and have a grip over the market sentiment is essential to have an idea of how things are going to pan out.

- Trading Platform: The MT4 trading platform gives a vigorous system of tools that prove to be extremely beneficial for technical analysis, automated trading, and to be in touch with real-time market updates.

Risk Management in Swing Trading

Effective risk management is a determining factor for long-term success in swing trading. Here are some strategies:

- Set Stop-Loss Orders: Protect your capital by limiting potential losses.

- Define Risk-Reward Ratios: Ensure potential rewards outweigh risks before entering a trade.

- Diversify Trades: Try to keep yourself from putting all your eggs in one basket, do not invest too heavily in a single currency pair.

- Use Leverage Wisely: While taking advantage of what CFD trading offers, it can also magnify gains as well as losses, so the factor of risk should never skip a trader’s mind.

Problems Occurring in Swing Trading

- Market Volatility: Sudden news events can disrupt carefully planned trades.

- Holding Overnight Positions: Overnight price changes can impact trade outcomes.

- Emotional Discipline: Avoiding impulsive decisions is critical.

- Analysis Paralysis: Overanalyzing market conditions can make you question your decisions and result in wrong choices.

Swing Trading Strategies

- Trend Trading

It encompasses identifying and trading in the path forward to move on the ongoing trending lines.

- Countertrend Trading

It consists of performing trade running opposite to the ongoing trend, working upon the process of capitalization on temporary changes or turnabouts in the market.

- Breakout Trading

Targets price movements that break through the set system of trade which has been in function since the beginning, signaling a continuation.

- Range Trading

This is more practiced when markets show sideways movements. Range trading includes buying at the support price and selling at resistance levels.

Frequently Asked Questions

- Q: What do you mean by swing trading?

A: Swing trading in the forex market means holding positions for a couple of days or weeks to gain the most out of the changes in price movements by using tools like MetaTrader 4.

- Q: Can swing trading be helpful for beginners?

A: Yes, swing trading can prove to be helpful due to its ideal nature consisting of a medium level of time required and dependence on technical analysis.

- Q: What currency is ideal for swing trading?

A: The most preferred currency for swing trading is mostly EUR/USD or GBP/USD due to its higher liquidity and guessable movements in the market.

- Q: Is MT4 trading a helpful platform for swing trading?

A: Yes, the MT4 trading platform has proved helpful as it offers high-tech tools and measures to enable strategies for swing trading.

- Q: What risks are present in swing trading?

A: Risks include market volatility, holding overnight positions, and emotional trading. Proper risk management is integral to neutralizing these.

Conclusion

Swing trading in forex provides a balanced approach between time commitment and potential profitability. By taking advantage of platforms such as MetaTrader 4, traders can analyze market trends, perform trades efficiently, and manage risk smoothly.

If you are a beginner or someone with experience, having a grip on swing trading will help you create a successful effect on your forex trade.

DISCLAIMER: This information is not considered investment advice or an investment recommendation, but is instead a marketing communicatio